Federal Poverty Level 2024 California Income Tax – And with a new tax year comes new opportunities to plan ahead for the income and expenses that will be reported on your tax return for the year. Since even a modest level of tax planning can save . For both 2023 and 2024, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets of 2024 and what you need to know. .

Federal Poverty Level 2024 California Income Tax

Source : www.healthforcalifornia.com

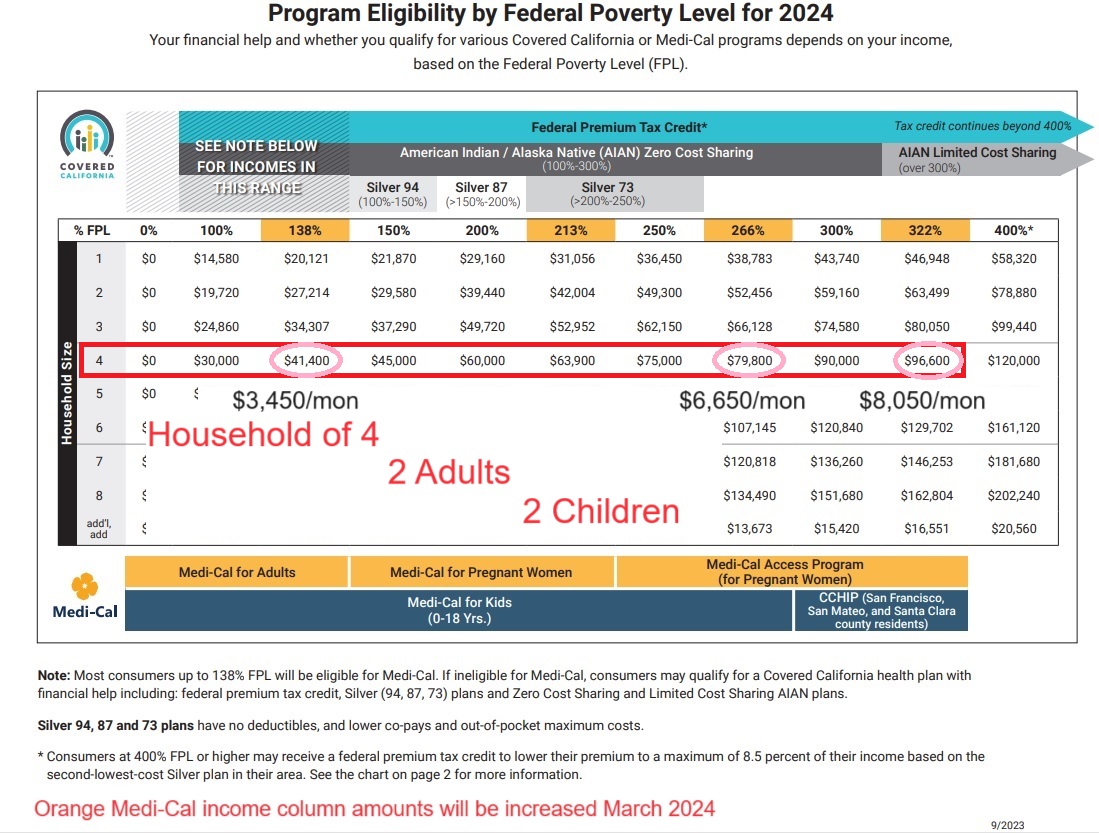

2024 Covered California Open Enrollment Income Table

Source : insuremekevin.com

Health Insurance Income Limits 2024 to receive CoveredCA subsidy

Source : insurancecenterhelpline.com

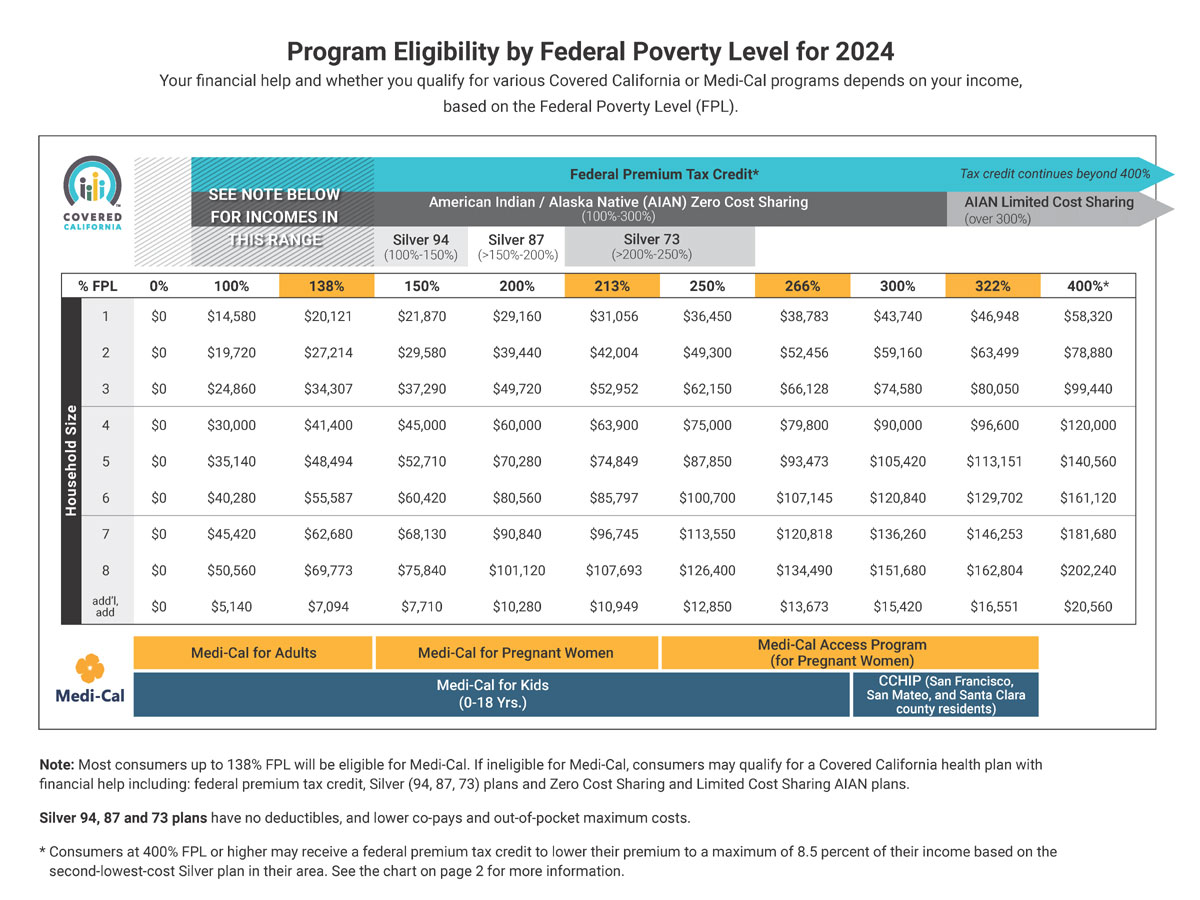

MAGI Income Chart Covered CA Subsidies Tax Credits FPL Poverty

Source : individuals.healthreformquotes.com

Covered California Income Limits | Health for California

Source : www.healthforcalifornia.com

2024 Covered California Open Enrollment Income Table

Source : insuremekevin.com

Covered California Votes to Lower Health Care Cost Sharing for

Source : health-access.org

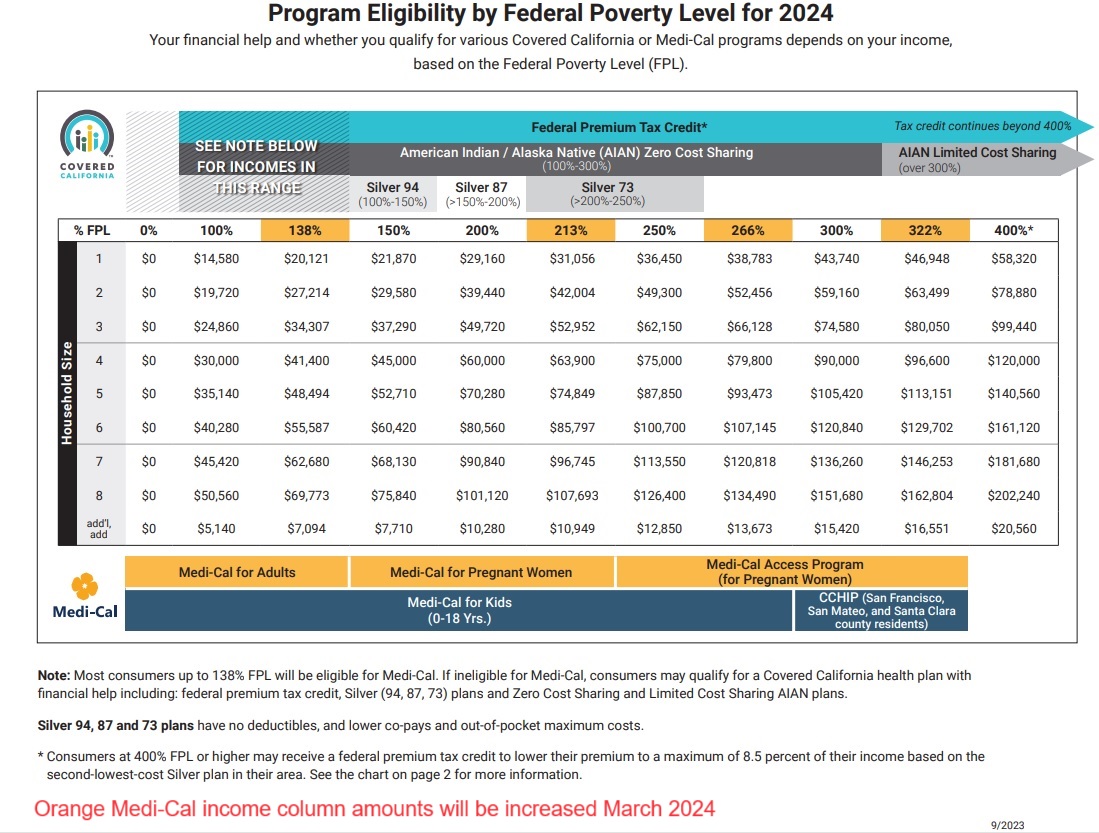

Covered California Income Limits | getcovered.us

Source : getcovered.us

Covered California Votes to Lower Health Care Cost Sharing for

Source : health-access.org

Covered California’s Health Plans and Rates for 2024: More

Source : www.coveredca.com

Federal Poverty Level 2024 California Income Tax Covered California Income Limits | Health for California: Your tax bill is largely determined by tax brackets. These are really just ranges of taxable income. As your taxable income moves up this ladder, each layer gets taxed at progressively higher rates. . The California Earned Income Tax Credit (CalEITC) is a state-level tax credit for low-to-moderate-income working individuals and families. The CalEITC is modeled after the federal Earned Income .

-1fdab78.png)